Major Changes Are Coming for Hawai‘i Homebuyers and Realtors

Legal settlements have disrupted how real estate agents are paid. Hawai‘i experts weigh in on what to expect next.

People buying homes in Hawai’i will soon see major changes in the way their real estate agents are paid.

Before agents show buyers a single home, they will likely have to negotiate compensation and sign written agreements. The agreements will spell out the services the agents will provide and what the agents will be paid for those services.

Maybe the compensation will be a cut from the selling agent’s commission – as has generally been done up till now – or maybe it will be a fixed fee paid by the buyer to the agent.

This new way of homebuying stems from a landmark settlement reached this year by the National Association of Realtors with mainland plaintiffs who sued over the way buyers’ real estate agents are paid.

Under a compensation model that’s been in place for more than 30 years, sellers pay their real estate agents commissions for selling their homes, often between 5% and 6% of the sale price. The listing agents, most of the time, share that commission with the agents who brought the buyers to the table.

But several lawsuits filed on the mainland challenged that model, alleging it was unfair for a seller to have to pay the buyer’s agent, even though NAR claims it was never required and that commissions are always negotiable.

A number of real estate firms, including some of the major brands with a market presence in Hawai‘i, settled with the plaintiffs before NAR reached its $418 million settlement on March 15. The settlement received preliminary approval a month later and is expected to be granted final approval in November.

Unlikely to Affect Home Prices

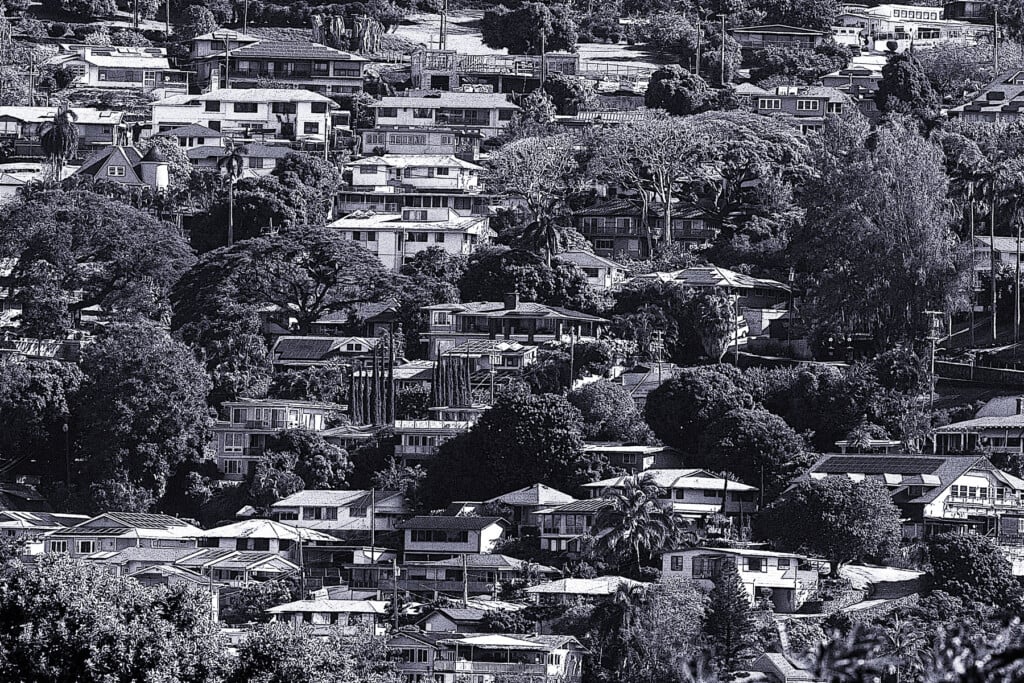

The settlement is unlikely to reduce home prices in Hawai‘i, where a limited inventory of houses and condominiums for sale keeps prices high.

“One of the challenging things has been a lot of the headlines and the information that you’re seeing in the media and, unfortunately, what consumers may be reading is really very misleading,” says Suzanne Young, executive director of the Honolulu Board of Realtors. “Commissions are not the cause of the housing prices. They’re a piece of the overall costs that buyers and sellers have to contend with, but they are certainly not the reason.”

One big change arising from the NAR settlement is that offers of compensation to agents who represent homebuyers must be removed from local Multiple Listing Services starting Aug. 17.

Consumers won’t see the changes since cooperative compensation data is typically visible only to agents on MLS.

NAR told its members that homebuyers can negotiate offers of compensation for their agents through the agents themselves – just not through the MLS. What form the compensation takes can vary: a concession from the seller or a fixed fee paid directly by the buyer or a portion of the listing broker’s commission.

The changes will require buyers to have conversations with their agents about compensation and to sign written agreements detailing the services their agents will provide and what those agents will be paid.

A New Way to Meet Prospects

The statewide Hawai‘i Realtors Association and local boards like the Honolulu Board of Realtors are working on getting sample agreements to agents and real estate firms throughout the state by this summer.

“It’s definitely going to evolve the way that buyers’ agents meet prospects and how they eventually contract them or become hired as their agents,” says Fran Gendrano, 2024 president of the Honolulu Board of Realtors and principal broker at KFG Properties.

She notes that prior to the 1990s, buyers often didn’t have their own agents, and commissions went to sellers’ agents alone. The NAR’s MLS cooperative compensation model rule was introduced in response to consumer protection advocates seeking representation for buyers.

“People forget that the reason why there was cooperation to begin with is because buyers did not have representation. That’s important for me to explain to a client how that came about. Because now it feels like people read the news and go, ‘Oh, great. I don’t have to pay the buyer’s agent.’ I don’t think that’s good for anybody.”

Gendrano says she’s already started having conversations about compensation with clients and is emphasizing the value her representation brings to a home purchase.

“Having a Realtor work for you does mean that you have somebody that’s looking out for your best interest, who’s held to a higher standard,” she says. “And I think that’s really important to emphasize to the consumer, that code of ethics that we follow, and some people tend to gloss over.”

More than just showing properties, a buyer’s agent works to educate clients, helps them put offers together and advises them through the issues that may pop up prior to the closing, says Julie Meier, 2024 president of Hawai‘i Realtors and a broker with Compass.

“It’s important and it’s best for the seller, and it’s best for the buyer,” she says. “I think a lot of sellers know buyers are putting all their money into buying this property. You want them to be represented. You don’t want them to come in unrepresented.”

Some Buyers May Try D.I.Y.

With the new way of homebuying, how a buyer’s agent is compensated may get complicated. There’s a chance the seller opts to not pay a commission that will cover the buyer’s agent. And a buyer who doesn’t have the extra cash to pay an agent may choose to go it alone.

“You’ve got a first-time homebuyer who has whatever percentage they’re able to save to purchase a house and now, on top of that, they’re going to have to pay cash for their own representation, as opposed to very clearly financing that in the context of a purchase,” says Matt Beall, CEO of Hawai‘i Life. “So that very well could be an unintended consequence of this.”

It can get thornier if the buyer is using a Veterans Affairs loan, because VA loan rules prohibit buyers from paying a commission to an agent.

That’s why some brokers will continue to recommend that sellers continue the practice of offering commissions to buyer agents.

“That will give them a competitive advantage,” says Beall. “Take the VA: If you’re in West O‘ahu and the great majority of the prospects for your property are veterans, it’s probably going to give you a competitive advantage to offer a cooperating broker’s commission to make it easier for them to buy the house.”

Fannie Mae and Freddie Mac, which set the rules for many mortgages, said in April that their rules allow sellers to contribute to a borrower’s closing costs, up to 9% of the property value. But they noted that commissions for buyers’ agents are not subject to that limit. Both organizations said they will “monitor and assess the impact” of the settlement to determine whether they need to change their policies.

Working With Prospective Buyers

NAR, for its part, has on its website an extensive list of answers to frequently asked questions. Among those are questions about when an agent has to ask a client to sign a buyer’s agent agreement.

NAR says that the agreement must be signed before buyers and their agents tour any properties. Just meeting with a prospective client or talking to one at an open house doesn’t require an agreement.

For the buyer, signing the agreement is a commitment to work exclusively with that agent for a time period, and perhaps within a certain area. The agreement also discourages a buyer from shopping around with multiple agents, like in cases where a buyer uses one agent to tour the home but signs the sales contract with another agent.

Meier says the buyer’s agreement will give the agent “procuring cause,” a term NAR defines in its arbitration guidelines as “the uninterrupted series of causal events which results in the successful transaction.”

“But if (clients) ever want to work with someone else, they just have to talk to you so that you can say that this (signed agreement) is terminated, and then they can move on to the next agent,” Meier says.

Another step buyer agents may take to emphasize their value is obtaining the NAR’s Accredited Buyer’s Representative designation. At the NAR’s recent Realtors Legislative Meetings in Washington, D.C., NAR President Kevin Sears encouraged members to take the course, which is free through the end of the year.

Meier says a lot of brokerages in Hawai‘i are doing their own training with agents on buyer representation and that it’s enlightening to see agents get excited when they enumerate the steps they take to help their clients buy a home.

“Here’s our chance to really show what value you have working with a Realtor,” she says. “Not everyone can do that, but what a benefit for a buyer.”

Young says she expects a period of adjustment for buyers, sellers and their agents.

“The reality is that nearly 90% of buyers and sellers choose to work with an agent and would continue to work with that agent again,” Young says. “It shows that there’s the understanding that this is the most complicated, largest financial transaction, not something that is simple to go through and so needing the services, the professional services, I think that will continue.

“I think we’re going to just have to ride this out for a little while to really understand what the real impact is going to be.”