Hawai‘i’s Top 250 Companies 2024

The 41st annual ranking of the state’s largest companies and nonprofits shows revenue was up, but the Lahaina catastrophe was widely felt – especially among small and medium businesses with Maui operations.

The 41st annual ranking of Hawai‘i’s companies and nonprofits shows a growing economy that has largely recovered from pandemic-era turmoil. While last year’s wildfire decimated businesses in Lahaina, many Top 250 companies largely weathered the disaster by having multiple locations and diversified offerings.

In a return to normal, HMSA has landed at the top of the list again, reporting a modest 3.1% increase in revenue in 2023. The local health insurance giant had occupied the top spot for seven straight years, until global events shifted the fortunes of other large Hawai‘i companies on last year’s list.

Par Hawaii was first on the Top 250 list in 2023, reflecting 2022 gross revenue, as energy prices surged after the Russian invasion of Ukraine and the subsequent U.S. boycott of Russian oil. Matson ranked second for gross revenue on that list after opening a new shipping line from China to California, and capitalizing on intense consumer demand for goods as the pandemic disrupted supply chains.

While Matson’s revenue fell nearly 29% in 2023 compared to the prior year, Chairman and CEO Matt Cox anticipated the drop when he told Hawaii Business Magazine in 2022, “I’m 100% sure that this super cycle we’re in will end and supply and demand gets back in balance.”

Matson’s 2023 year-end report notes that “consolidated operating income declined primarily due to lower volume and freight rates in our China service as the transpacific marketplace transitioned from the pandemic period.”

Par’s revenue was down 9% in 2023 amid a drop in global crude oil prices, which drive gross revenue at Hawai‘i’s sole petroleum refinery and leading distribution company.

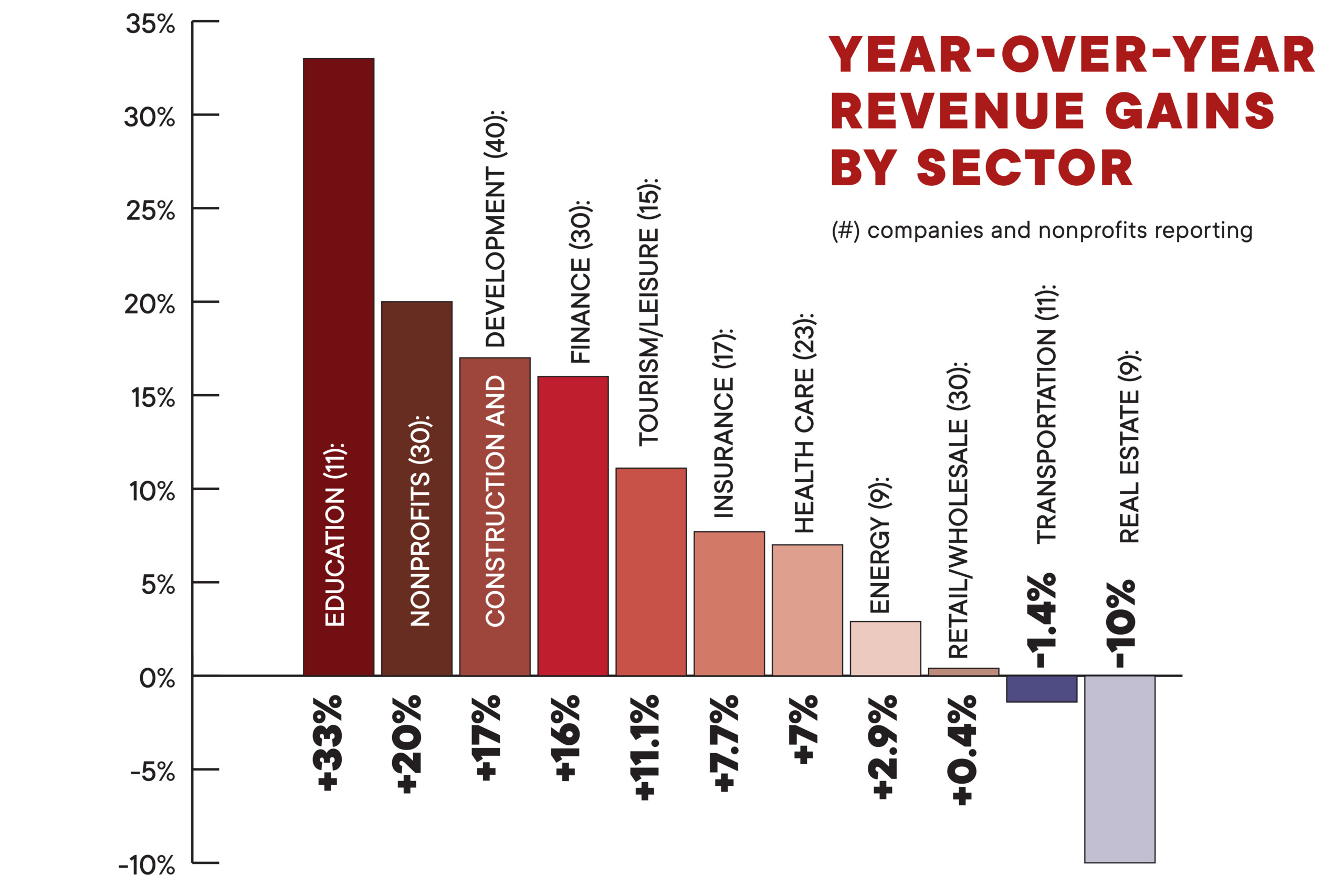

But about 75% of companies and nonprofits on this year’s Top 250 list reported revenue gains in 2023 over 2022. Revenue was up in most sectors represented on the list, including a 20% gain among nonprofits, a 17% gain among construction and development companies, and a 16% gain in the financial sector.

The results reflect an overall solid economy. Hawai‘i’s real gross domestic product, the broadest measure of economic activity, grew by 3.6% in 2023, according to data from the UH Economic Research Organization. Inflation-adjusted visitor spending rose last year. And unemployment in the Islands was just 2.9% by the end of 2023, lower than the national average.

Top 250 Facts

- 12 companies and nonprofits reported gross revenue of $1 billion or more

- 19 employed 1,000 people or more

- 16 are headquartered on Maui

Yet Pessimism Abounds

Despite these rosy figures, many business leaders in Hawai‘i are worried about the current economy, marked by stubbornly high prices. The cost of housing pushed Honolulu’s consumer price inflation to 4% through much of 2023 – higher than the U.S. rate of about 3%, according to UHERO.

In a related story in the August 2024 issue of Hawaii Business Magazine, the BOSS survey of 407 local business owners and executives found that optimism about the future has steadily dropped in multiple surveys after peaking in April 2021. In the latest survey, only 16% of respondents thought the local economy would improve in the coming year or two, while 42% thought it would get worse. And just 42% were completely confident that they would be in business three years from now, compared to 56% a year earlier.

Some other trouble spots in Hawai‘i are population declines that translate into a smaller labor force and less economic growth than you would get from a growing workforce. Lagging visitor numbers – driven largely by fewer arrivals to Maui and a weak international market – are expected for the whole of 2024, along with a spending drop of about $1 billion, says Carl Bonham, executive director of UHERO, in his second-quarter economic forecast.

Bright spots are building efforts on Maui and federal construction spending, says Bonham in the 2024 forecast. In 2023, the two top construction companies on this list, Hawaiian Dredging and Nan, reported gross revenue gains of 36% and 37%, respectively, over the previous year – a trend that may drive the state’s economy in 2024.

Lahaina’s Far-reaching Impact

Many companies on the list were affected by the destruction of Lahaina on Aug. 8, 2023. In our November 2023 issue, Hawaii Business reported on Kaiser Permanente’s destroyed clinic and the rollout of its mobile clinics, and on First Hawaiian Bank’s ruined Lahaina branch and vault retrieval.

While these large organizations are often able to withstand calamity, pending lawsuits against Hawaiian Electric Industries, Hawaiian Telcom, Kamehameha Schools and others for alleged negligence in allowing the wildfire to start and spread could deliver a harsh financial blow.

Kaiser Permanente ranked 7 on this year’s list, and First Hawaiian ranked 12. Kaiser’s revenue was up in 2023 by more than 7% and First Hawaiian’s by more than 33%. Bank of Hawai‘i, the second-largest bank on the Top 250 list after First Hawaiian, also lost a branch on Maui but reported a nearly 31% revenue gain last year, though both banks reported lower profits in 2023.

In the middle of the list are organizations such as Maui-based VIP Foodservice – ranked 103 on this year’s list – which reported a downturn of 3.3% from the previous year’s revenue. For two months, the company lost use of its Lahaina grocery store, Island Grocery Depot, and its food-distribution service to clients such as hotels, restaurants and schools in Maui County was badly hurt.

The Pacific Whale Foundation, a nonprofit based on Maui that employs 120 people, is a marine research and conservation group that hosts educational programs for grades K-12. It also owns an eco-tour business and store near Mā‘alaea Bay to help fund its mission. From August through the end of 2023, the organization lost half its business, says executive director Kristie Wrigglesworth; gross revenue for the entire year was down more than 15%.

Smaller companies on the list, such as JR Doran/Ceramic Tile Plus, based in Kahului, saw a 15% drop in revenue over the prior year – a direct result of less business after the wildfires. Atlantis Submarines’ revenue was down 20% in 2023 after it shut down its submarine tours off Lahaina, although its Waīkikī and Kona operations continue.

Loss of Most Profitable Store

Another local company, The Art Source, ranked 179 on this year’s list, lost its single most profitable CocoNene store, which was located on Lahaina’s Front Street. CEO Kent Untermann and his wife, VP Lori Untermann, are also half owners of the building, making the loss a “double hit,” he says.

“Just before the fire, we were hitting our stride,” he says, with the Front Street store bringing in about $300,000 a month in revenue. About $130,000 a month went to support local jobs, including store employees, factory workers and artists; the company’s average pay is $33 an hour, says Untermann.

In true Untermann style, the company leapt into growth mode. “There are different ways to approach it. One is to be more conservative and the other is to be more aggressive,” he says. “I have the tendency to be more aggressive.”

Untermann says he had generous business-interruption insurance that helped the company get back on its feet. He immediately added $800,000 in equipment to the manufacturing operations in Kapolei.

At the 43,000-square-foot facility, The Art Source produces custom cabinets, closets, frames, gifts and home décor for its numerous brands, including Pictures Plus, Plus Interiors and CocoNene. It’s one of the few durable-goods manufacturers in Hawai‘i, where nondurable goods are more commonly produced; the small manufacturing sector makes up only 1.63% of the total output in the state, according to the National Association of Manufacturers.

Untermann says that while manufacturing is difficult in pricey Hawai‘i, it’s not impossible. “We believe with good automation, good people and training, and unique products that we can make things on the island, and we’re proving that you can do it.”

The company’s diversified products help it weather the economy’s highs and lows by selling to the construction industry, affluent local consumers and the tourist market, which he sees as a growth area for CocoNene.

Two new stores are opening in the coming months, adding to the seven now operating across the Islands, and more are planned. The stores sell Hawai‘i-made gifts and home décor for both the visitor and local markets, and are a recent evolution away from the slipper stores formerly operated under the brand Island Sole.

Untermann is now working with other local business leaders to advocate for restoring Front Street, which he calls “one of the richest miles of commerce in Hawai‘i.” He says that most tourist dollars in Lahaina stayed with the people who lived and worked there.

“If we don’t rebuild, we’re going to lose it,” he says. “Or worse, if it went to mainland enterprises, then all that money would leave the Islands.”

At the end of 2023, The Art Source had made up the $1 million loss it suffered last year from the Lahaina fire, reporting $22.4 million in gross sales – an increase of 3.2% over the previous year’s numbers.

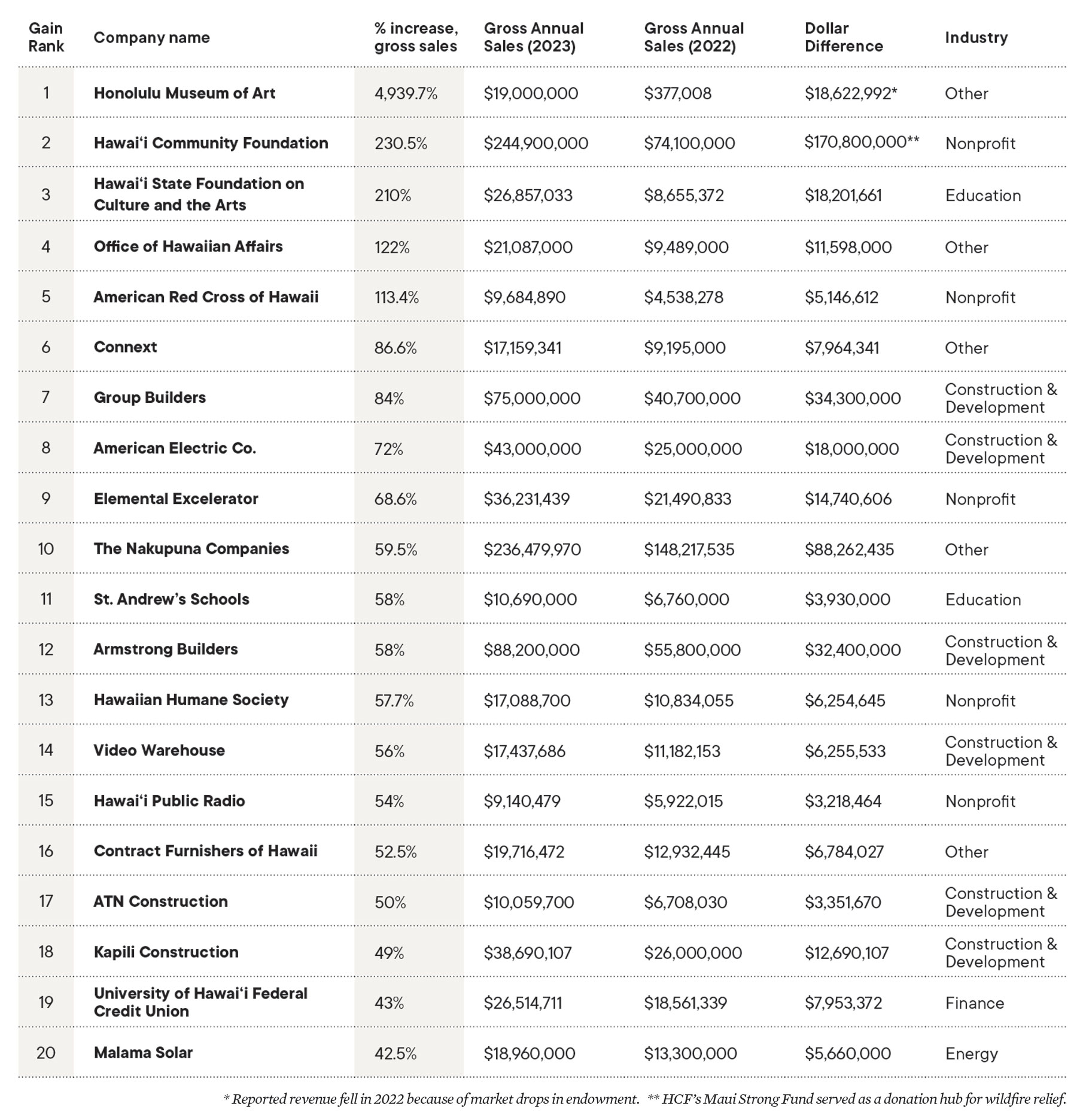

Biggest Gains

Ranked by percentage change in gross annual sales/revenue

For the complete printed list, get your copy of the August 2024 issue here.

How We Compile the Top 250

Top 250 companies and nonprofits are ranked by gross sales or gross revenue, key indicators of market strength and influence.

Each spring, Hawaii Business Magazine surveys companies in our database and gathers updated financial figures, employee counts, names of executives and other information.

Businesses are asked to calculate gross sales using generally accepted accounting principles, while nonprofits report revenues from contributions, funding for services or proceeds from activities that support their missions. All provide the name of an executive who verifies the self-reported figures. Companies headquartered in Hawai‘i report sales from all their subsidiaries worldwide; those based elsewhere report Hawai‘i figures only. While we prefer calendar year data, some organizations operate on a fiscal year.

To supplement the survey process, we draw on public records such as annual reports, financial statements, databases of the Federal Deposit Insurance Corp. and National Credit Union Administration, and insurance figures from the state Department of Commerce and Consumer Affairs.

Some companies with a large local presence don’t appear on the list. The omission is often because an offshore parent company can’t or won’t report separate data for its Hawai‘i operations, or because the company is privately held and does not disclose financial information.

Top 250 executives are surveyed and profiled in our Black Book issue each December.

Join next year’s Top 250. If you would like to receive Top 250 surveys in the future or update your contact information, please email cynthiaw@hawaiibusiness.com.