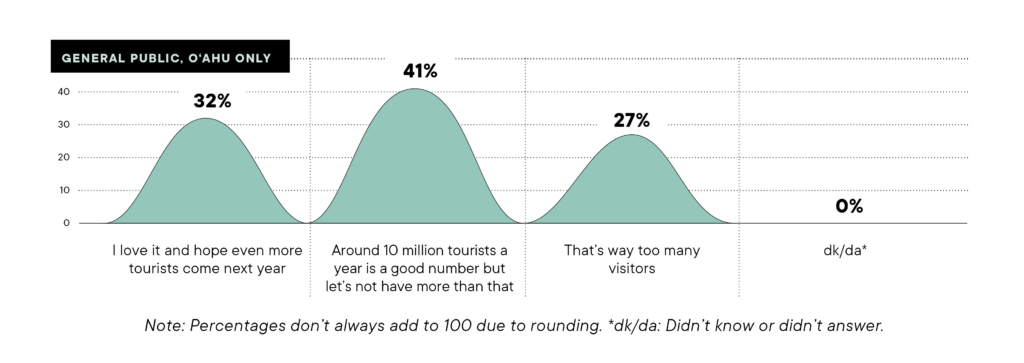

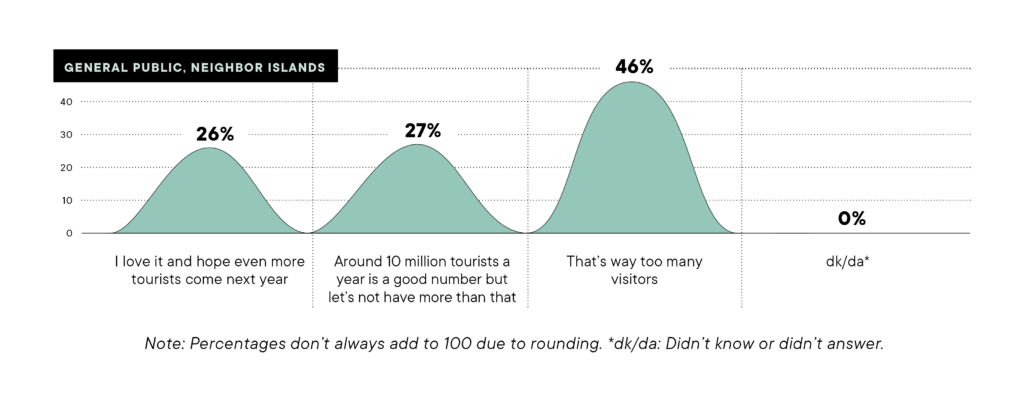

Mass Tourism Is Fine, Say 69% of Business Leaders and 73% of O‘ahu Residents

The BOSS and 808 surveys also show that many businesses are tightening their budgets in anticipation of slow growth ahead.

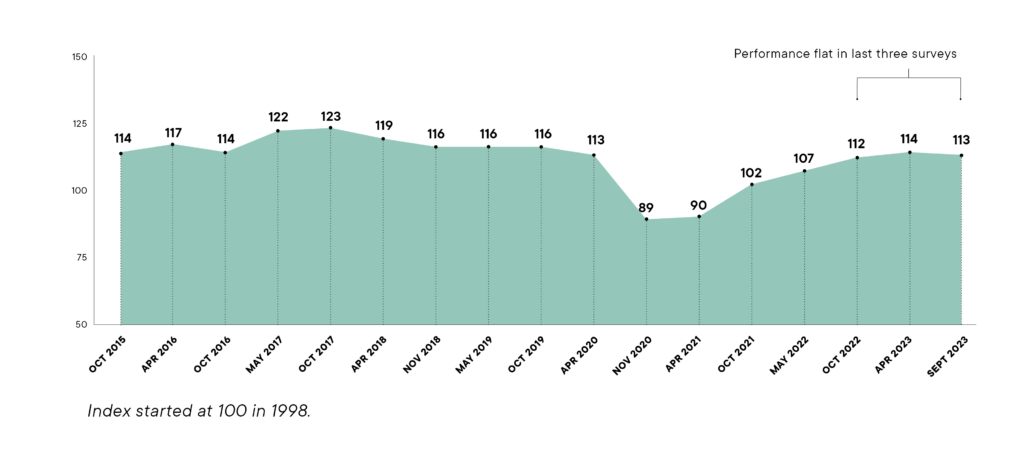

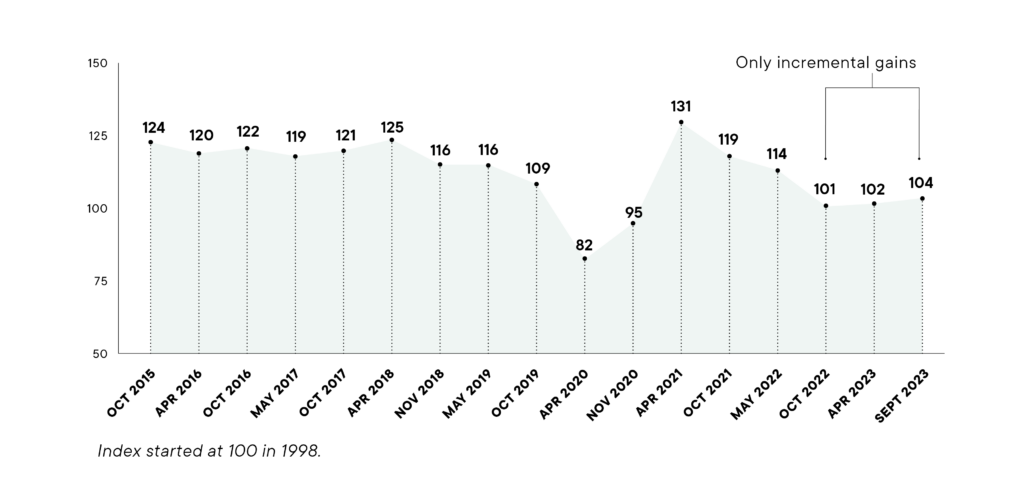

The BOSS Survey generates two indexes. The Performance Index measures changes over the past year in employment, gross revenues and profit before taxes among the companies surveyed. Did those measures go up, down or hold steady?

The Optimism Index reveals the business community’s outlook for the economic future of the Islands over the next year.

BOSS Performance Index

The latest three BOSS Surveys have shown similar results on the three major measures of business performance. Here are the results from the latest survey.

- Employment: 65% of the companies surveyed maintained the same staffing level over the past year, 19% increased staff and 16% cut staff.

- Gross Revenue: 43% of the companies surveyed enjoyed greater revenue in the past year, 28% were flat and 27% had less revenue.

- Profit Before Taxes: 34% achieved larger profits before taxes in the past year, 30% held steady and 33% suffered lower profits before taxes.

BOSS Optimism Index

Of the business leaders surveyed, 26% said they believe the economy will improve in the coming year – more jobs, business growth, revenue growth. Meanwhile, 35% said it will remain flat and 38% fear it will worsen – fewer jobs, more bankruptcies, revenue loss. Of the businesses on Maui, 72% said things would get worse.

Of the business leaders surveyed, 26% said they believe the economy will improve in the coming year – more jobs, business growth, revenue growth. Meanwhile, 35% said it will remain flat and 38% fear it will worsen – fewer jobs, more bankruptcies, revenue loss. Of the businesses on Maui, 72% said things would get worse.

Again, both the 808 Survey and 808 Poll were taken in the weeks soon after the Lahaina fire.

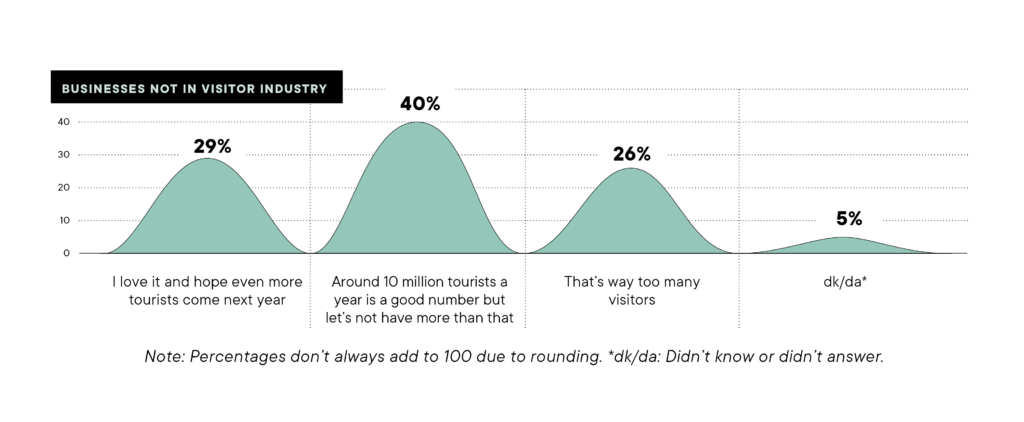

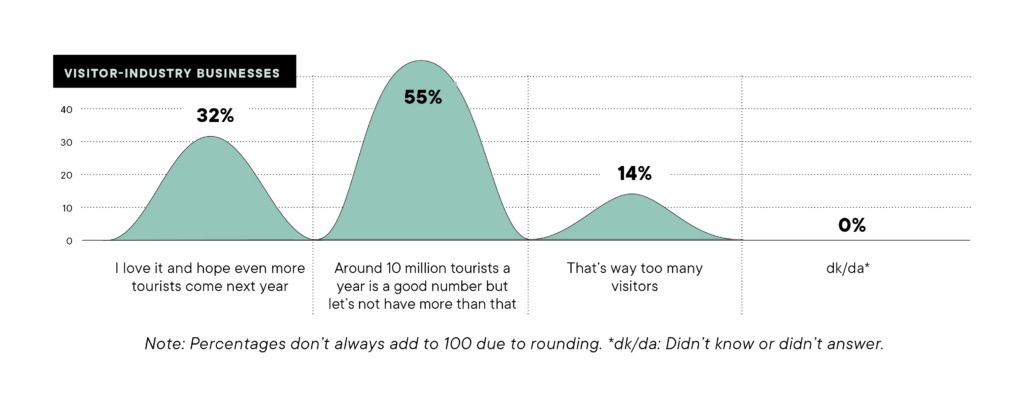

How Many Tourists?

Each survey participant was presented with this statement: The number of visitors arriving in Hawai‘i this year is running at about 94% of the peak tourism year of 2019, when more than 10 million visitors came.

They were then asked which of these statements best mirror their personal views.

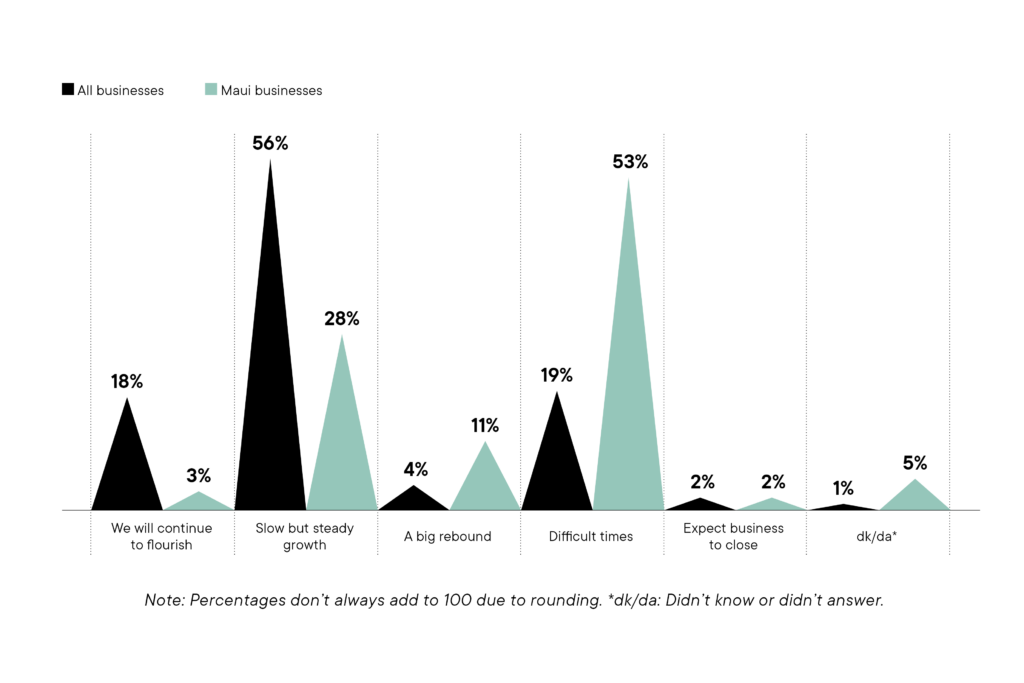

Will Your Company Flourish or Suffer Difficult Times?

Business leaders were asked to characterize their companies’ prospects over the next two years using these options.

“Unprecedented uncertainty for the second time in just a few years after the Maui fire is hard on all stakeholders.”

-Boss Survey Respondent

Methodology for BOSS Survey and 808 Poll

BOSS – the Business Outlook and Sentiment Survey – is a statewide survey of business owners, senior executives and other company representatives. The 808 Poll is a survey of the general public in Hawai‘i. Both are conducted twice a year for Hawaii Business Magazine by the research team at Anthology Marketing, now part of the global agency Finn Partners.

For the BOSS, a total of 404 random interviews were conducted on the four most populated Hawaiian Islands from Aug. 15 to Sept. 13, 2023, after the tragic fire in Lahaina. A sample of this size has a margin of error of plus or minus 4.88 percentage points with a 95% level of confidence.

A survey within the main BOSS Survey involved interviews with business leaders who describe their companies as generating significant revenue from the tourism industry. A total of 111 leaders were surveyed in this segment; their responses were also included in the main survey results.

In the 808 Poll, 463 members of the general public age 18 and older were surveyed from Aug. 15 to 28, 2023. The margin of error for a sample of this size is plus or minus 4.55 percentage points with a 95% confidence level.

Thirty-five of the BOSS respondents live on Maui; 26 of them help lead companies in the tourism industry. Fifty-five of the 808 respondents live in Maui County. These are small sample sizes, but we felt their collective responses were worth separating out on certain survey questions when they differed significantly from the overall responses.

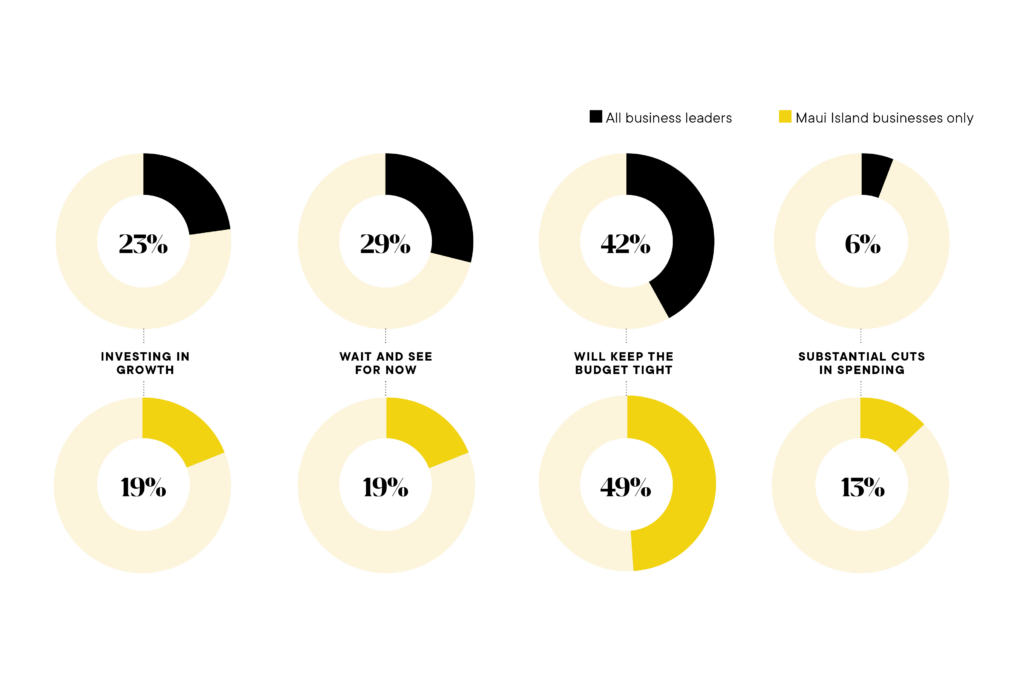

What Are Your Company’s Plans for 2024

Participants in the BOSS Survey of business owners, executives and representatives were presented with the following: Fears about a recession have diminished in recent months among some economists and business leaders; others still fear a recession in 2024.

They were then asked which of the following options best mirror their company’s plans for the near future.

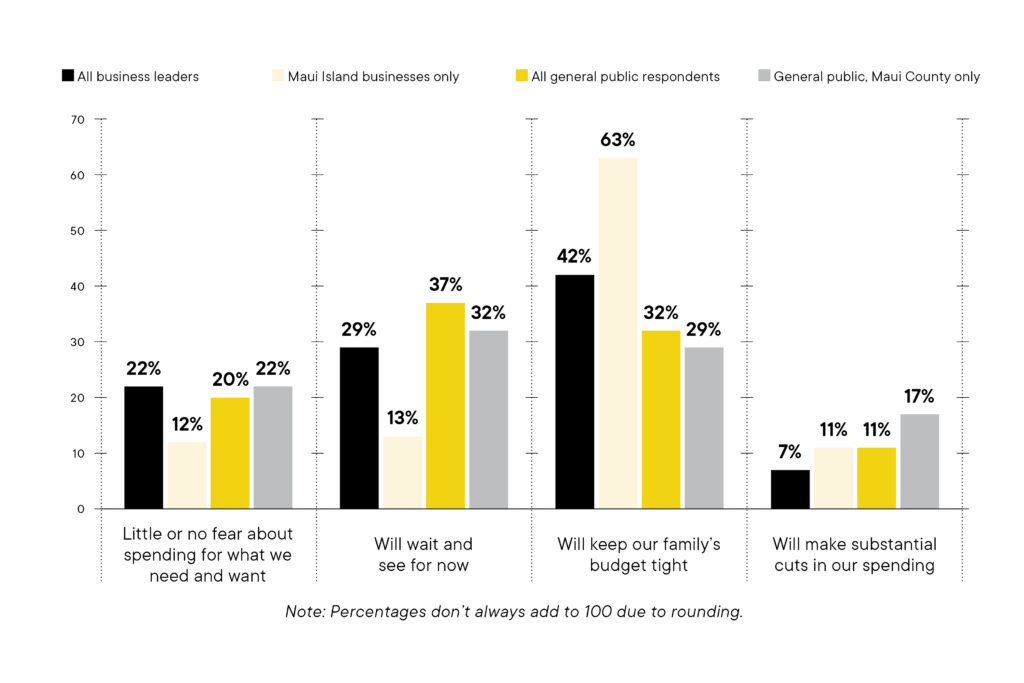

Participants in both the BOSS Survey of business leaders and the 808 Poll of the general public were asked about their personal plans related to spending and budgeting in 2024.

Among the general public, 28% of men have little or no fear about spending in 2024 compared with 14% of women; 17% of women anticipate substantial cuts in spending compared to just 5% of men. Unsurprisingly, among the general public, the largest proportion of those with restricted spending plans came from those in the lowest income tier – household income of less than $50,000 a year.