Higher Selling Prices Can Mean Higher Taxes. Here’s How to Lower the Tax Bill.

Homeowners are guaranteed a tax break on capital gains up to a fixed amount, while owners of investment properties can defer those gains using a 1031 exchange. But “timing is important” for the strategy to work, says Julie Bratton of Old Republic Exchange Co.

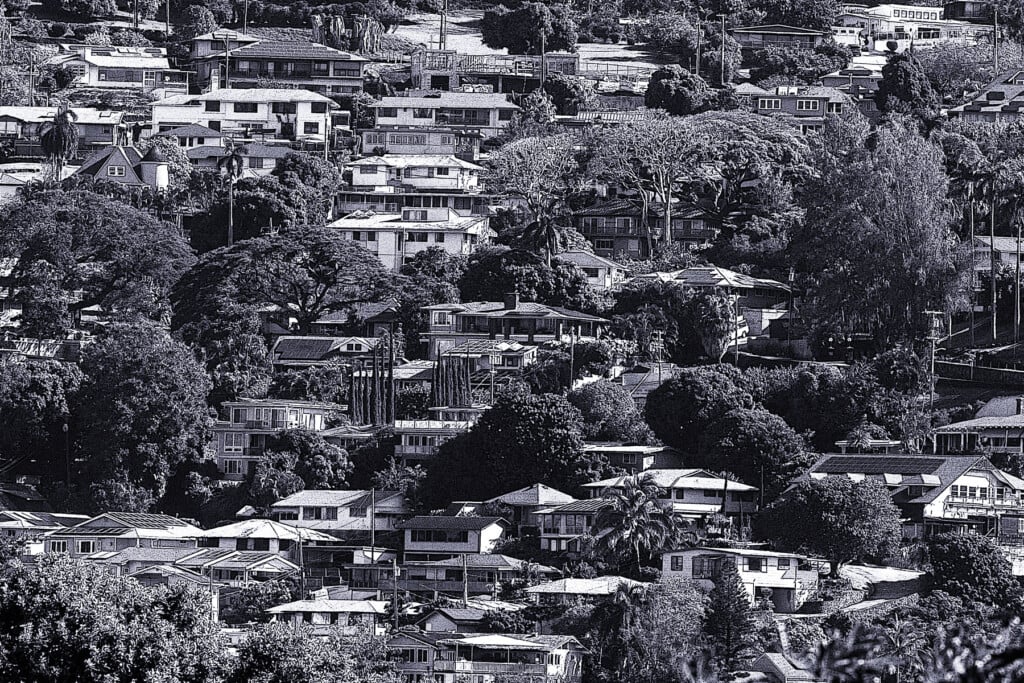

With all of the equity Hawaiʻi homeowners have gained over the past three years, some sellers will need to pay close attention to taxes when selling their properties or they could face steep capital gains tax bills.

The Internal Revenue Service allows sellers to exclude a limited amount of capital gains from the sale of their primary residence – $250,000 for an individual or $500,000 for a married couple who files a joint return. That means if someone has owned and used the home as a primary residence for at least two years during the five years leading up to the sale, they won’t have to pay capital gains tax on the first $250,000 or $500,000 in profit.

But sellers of investment properties may defer those gains, as well as federal capital gains taxes of 15% or 20%, by using a like-kind exchange under the IRS Code Section 1031, also called a 1031 exchange.

To be eligible, the property – which can be a house, condo, land or commercial property – must have been held as an investment or used for a business. That stipulation applies to most rental homes and condos, and some homes that are also used as vacation rentals.

Julie Bratton, vice president and regional manager at Old Republic Exchange Co. | Photo: courtesy of Old Republic Exchange Co.

The seller has 45 days from the sale of the first property to identify a replacement property with a price equal to or greater than the one sold. Then they have a total of 180 days to close on that transaction using the proceeds from the sale of the first property. That 180 days – about six months – includes the first 45 days as well as weekends and holidays, so the seller must plan accordingly.

“It’s all about the timing,” says Julie Bratton, vice president and regional manager at Old Republic Exchange Co., one of several firms in Hawaiʻi that act as a qualified intermediary in 1031 exchanges. “Timing is important.”

Sellers of rental properties have been using 1031 exchanges for years, but more so since the Covid-19 pandemic sent property values skyrocketing. On Oʻahu alone, median prices in May were up by 39% for single-family homes and by 26.5% for condominiums when compared to May 2020.

“(Business) has been upticking for so long and right now it’s steady,” says Bratton.

The properties exchanged don’t have to be in the same state, she says. That means someone could sell an investment property on the mainland and buy a house or a condo in Hawai‘i, or even multiple homes, using a 1031 exchange. Likewise, someone could sell a home on a Neighbor Island and buy a replacement property on Oʻahu, or vice versa.

Some investors use the exchange as an estate-planning tool by selling one property and using the proceeds through a 1031 exchange to buy multiple properties for their children to inherit, Bratton says.

“(You can) sell your $6 million property and buy four condos, one for each kid, rent them out, and then when you die they get to step up,” she says.

Others look to use an exchange to buy properties with higher income potential, which makes the new condos being built in Kakaʻako attractive. The strict time rules for 1031 exchanges can make it difficult because of the two-year wait to close on a condo under construction, but Bratton says there are ways to do it.

“People could actually take advantage of today’s market, sell, do an exchange, get into a different investment property,” she says. “Hold that for a year or so, the longer the better, and then do an exchange into the new unit.”