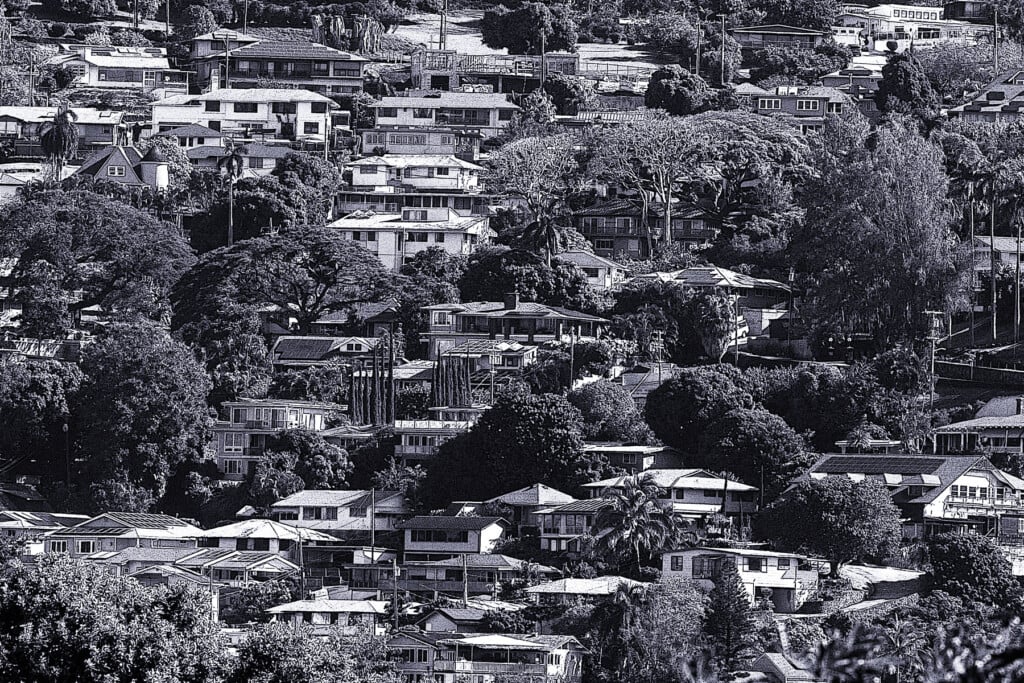

Number of Homes for Sale Goes Up in Some Parts of O‘ahu

One Realtor says prices will likely go up fast when interest rates fall, so eager buyers are being encouraged to close on deals now and then try to refinance in a few years at lower rates.

The rise in interest rates since March 2022 has curtailed the number of homes sold in Hawai‘i. Nonetheless, there is still a demand for homes and condos on Oʻahu and the number of properties on the market is increasing in certain areas.

Looking to the past, Realtors point out that today’s rates, hovering around 7%, are relatively reasonable. For instance, during most of the 1970s, ’80s and ’90s, rates were higher for 30-year fixed rate mortgages than they are today.

Chad Takesue, partner and COO of Honolulu real estate firm Locations, also says that before and during the Great Recession, rates for 30-year fixed-rate mortgages fluctuated between 6% and 7%.

Chad Takesue is a partner and the COO of Honolulu real estate firm Locations.

“But because inventory grew during that time, it offset the price pressures,” so prices were more affordable than they are today, Takesue says. “The demand hasn’t changed. The demand is there, it’s just a matter of what people can afford.”

Inventory, or the number of homes for sale, has declined over the past two years largely because homeowners who bought or refinanced when rates were below 4% are reluctant to sell knowing that mortgage rates on their next homes will be higher.

Those sellers who are offering their homes for sale are employing different strategies than two or three years ago, when open house lines snaked around the block and multiple offers were the norm.

“Sellers are definitely more in tune with the market,” Takesue says, noting that sellers in areas where inventory has increased have had to adapt to more competition.

“Don’t get me wrong, there are still multiple offers coming through in certain areas,” Takesue says. “But I’m seeing in some markets where the sellers are getting very strategic and helping to offer credit to help the rate for the buyer.”

Buyers then use that credit to buy down the interest rates on their mortgage loans, which “really helps with the affordability of that particular list price,” he says.

For example, a buyer who has a mortgage at 7.25% with no points may have a lender that allows them to buy down to a 7% loan with two points, which is equal to 2% of the loan amount. Those points would cost $20,000 for a $1 million home.

“That’s usually what drives how much credit they would want to try to achieve,” Takesue says.

Condo Inventory Up in Makiki, Salt Lake and Mililani

That’s tending to happen more in areas where inventory, hence competition, has increased, he says. While inventory over the past year and a half has dropped as rates have risen, the number of properties for sale has increased recently in certain areas, according to Locations’ monthly market report.

The overall number of active listings for Oʻahu condos increased in August to 1,192 units. The areas seeing the biggest increases include Makiki, which increased 42% to 78 units for sale, compared to 55 in August 2022. Other areas with more active condo listings include Salt Lake, up 45%, and Mililani, up 38%. Single-family home listings decreased in most markets but increased in Kāneʻohe by 22%, Nuʻuanu-Makiki by 19%, and ʻEwa by 6%.

Meanwhile, Takesue says he’s been telling people to go ahead and buy in this market if they have a need and they can afford it, even though rates are still relatively high.

“Because when rates do start to come down, you know what’s going to happen with pricing,” he says, echoing others who predict prices will rise when rates drop and buyers who had been on the sidelines jump back in. “Lock your price now and hopefully you have an opportunity to refinance when rates come down.”