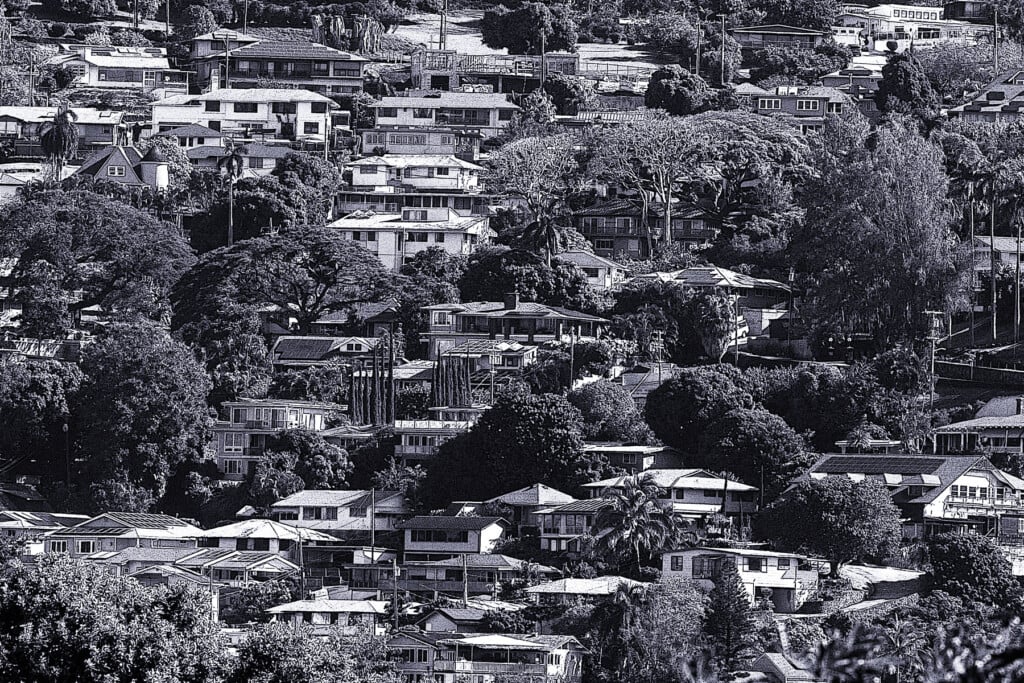

Six Areas of O‘ahu Have Lots of Homes for Under $1 Million

In each of those places, prices so far this year are lower than last year.

Believe it or not, it’s still possible to buy single-family homes for less than $1 million – and in the six least-expensive areas of O‘ahu, median prices are actually lower than a year ago.

In Pearl City-ʻAiea, the median price through the first eight months of this year was $950,000, which was 12% below the median in the first eight months last year.

Other areas with median prices below $1 million through August were the ‘Ewa Plain, Kalihi-Pālama, Mākaha-Nānākuli, Wahiawā and Waipahu. In each of those areas, the median price this year was below the same period last year.

Fran Villarmia-Kahawai, president of the Honolulu Board of Realtors and principal broker at Lifehouse Realty in ʻAiea, says buyers can even find some homes in pricier regions for less than $1 million.

Fran Villarmia-Kahawai is president of the Honolulu Board of Realtors this year and principal broker at Lifehouse Realty in ʻAiea.

“There’s a lot of neighborhoods that still are maybe affordable,” she says. “There’s little pockets here and there, and it depends on the buyer and what they want.”

For example, the median home price on the ‘Ewa Plain in August was $900,000. But Villarmia-Kahawai, notes that the region stretches from West Loch to Ko Olina Resort, with dozens of neighborhoods, including older ones such as ʻEwa Villages. There, the 15 homes sold through the end of August had a median price of $775,000.

She says a lot of the people looking at these less-expensive homes are first-time homebuyers who may not be able to afford more, or don’t have large down payments, while some may be families that have outgrown their condominiums or townhomes. Some tried to buy during the heated pandemic market, when agents were fielding more than a dozen offers on many listings, but missed out.

“They may have gotten outbid in the frenzy before, but now they’re coming back and there’s not much of a frenzy now,” she says. “It’s a little bit more calmer, and so they can take a look around and this is their opportunity to get into that single-family with less competition.”

What the average buyer can afford today is markedly different from what the average buyer could afford two years ago, when interest rates for mortgages were around 3%. The average rate for a 30-year fixed-rate mortgage last week was 7.19%, according to Freddie Mac.

“The interest rates being higher drove the buying power down,” Villarmia-Kahawai says. “So more buyers are stuck in this price point. And not only interest rates, but property taxes went up, insurance costs went up. So that adds into their whole mortgage payment when they qualify and it pushes everybody a little lower.”

Here’s a look at places on O‘ahu where the median price for a single-family home through Aug. 31 was less than $1 million, and the difference from the same eight-month period in 2022:

- ʻEwa Plain | $898,500, down 4%

- Kalihi-Pālama | $905,000, down 4%

- Mākaha-Nānākuli | $675,000, down 6%

- Pearl City-ʻAiea | $950,000, down 12%

- Wahiawā | $840,000, down 7%

- Waipahu | $915,000, down 5%