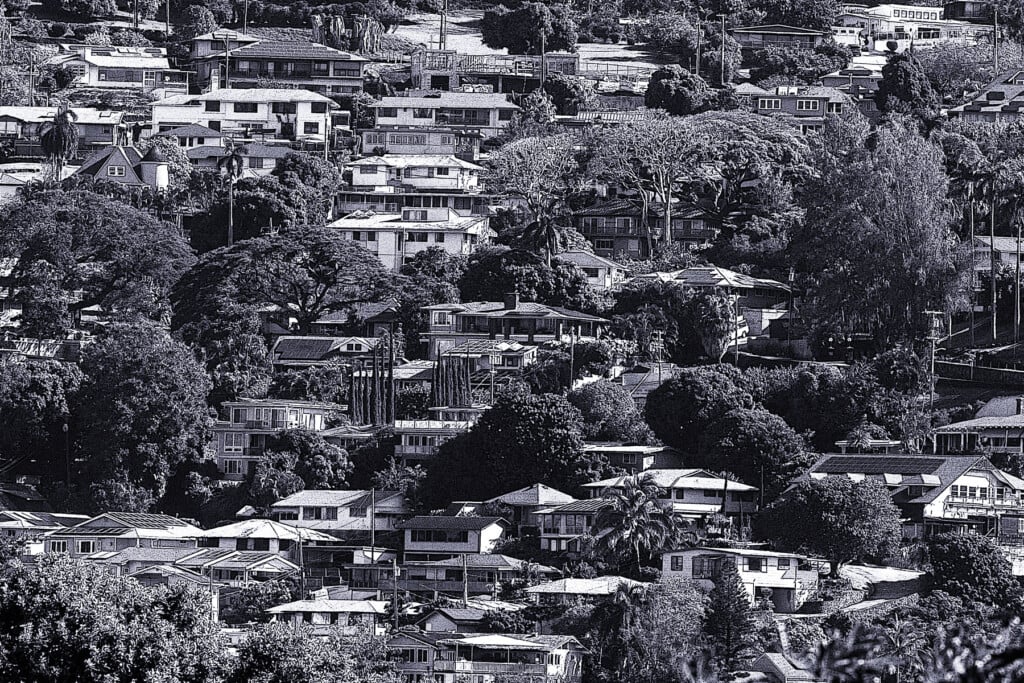

Federal Program Offers Mortgage Lifeline for Some Maui Residents

The mortgages come with no down payments, but max out at $977,500, which limits what they can buy in Maui’s expensive housing market.

The federal government has a mortgage loan program for people in places that the president has declared disaster areas – and that program could be a valuable financing tool for people who lost their homes to the wildfires in Lahaina and Kula.

The U.S. Department of Housing and Urban Development announced within days of the Aug. 8 fires that its Section 203(h) was available to provide mortgages insured by the Federal Housing Administration, which means borrowers may get 100% financing, including closing costs.

David Browne, a mortgage broker at Makai Mortgage in Kīhei, says such a Section 203(h) loan could be a game changer for many people because it doesn’t require any money down. He’s already completed a loan for one family and has two more in escrow.

“It doesn’t matter if you were a homeowner or a renter,” Browne says. “If you can prove you were displaced by the fires on Maui, you’re eligible to see if you qualify for this program.”

Borrowers’ homes don’t have to have been destroyed for them to qualify. For example, if someone’s home is in an area that’s still restricted from entering, that person could qualify to buy another place, he says.

And borrowers could qualify even if they have existing mortgages on homes that have been damaged or destroyed, Browne says.

“One of the most important features of this program is that it allows me to qualify the borrower without using the previous mortgage payment for the home that was destroyed in their debt-to-income ratio, which is huge because most people wouldn’t qualify for two mortgage payments simultaneously,” he says.

These borrowers must prove they’re in contact with their existing lenders, he says, adding that most people he’s spoken with have done that and are taking advantage of forbearance periods that pause their mortgage payments. In many cases, people will soon receive payouts from their homeowners insurance policies that can be used to pay existing mortgages.

“One of the biggest things that I want to convey is that people aren’t having to sell their land or property in order to make this happen,” says Browne. “It allows people who want to stay on Maui to stay on Maui.”

Rules Limit Eligible Condo Properties

While the FHA program requires borrowers to be employed, it also accepts that they may have recently been temporarily unemployed because of the fires. Such breaks in employment usually hurt people’s chances at qualifying for a mortgage.

But there are caveats that limit which homes people can choose from.

The loans are only available through FHA-approved lenders. And while these loans don’t require the typical FHA minimum of 3% down, they’re capped at $977,500.

Browne notes it would be difficult to find a single-family home on the Valley Isle for less than that – the median single-family home price so far this year on Maui is just under $1.2 million – so condominiums may be a better option. The median price of a condo on Maui through the end of September was $825,000, according to the Realtors Association of Maui.

However, another caveat further winnows qualifying properties: They can only be in condo buildings or complexes that do not allow short-term rentals, or vacation rentals. Browne notes three of the condo complexes in Lahaina that may have qualified – Hoonanea at Lahaina, Kahoma Village and Opukea at Lahaina – were either destroyed or are in areas where residents have not yet been allowed back.

The other caveat is that for a condo building to be FHA approved, it must have owner occupancy of 50% or more and no pending lawsuits. That leaves three buildings – Kihei Shores and Kihei Villages in South Maui and Iao Parkside in Wailuku – that are already FHA-approved.

Browne says it is possible to get spot approvals from the FHA for other buildings, but only if they meet those criteria.