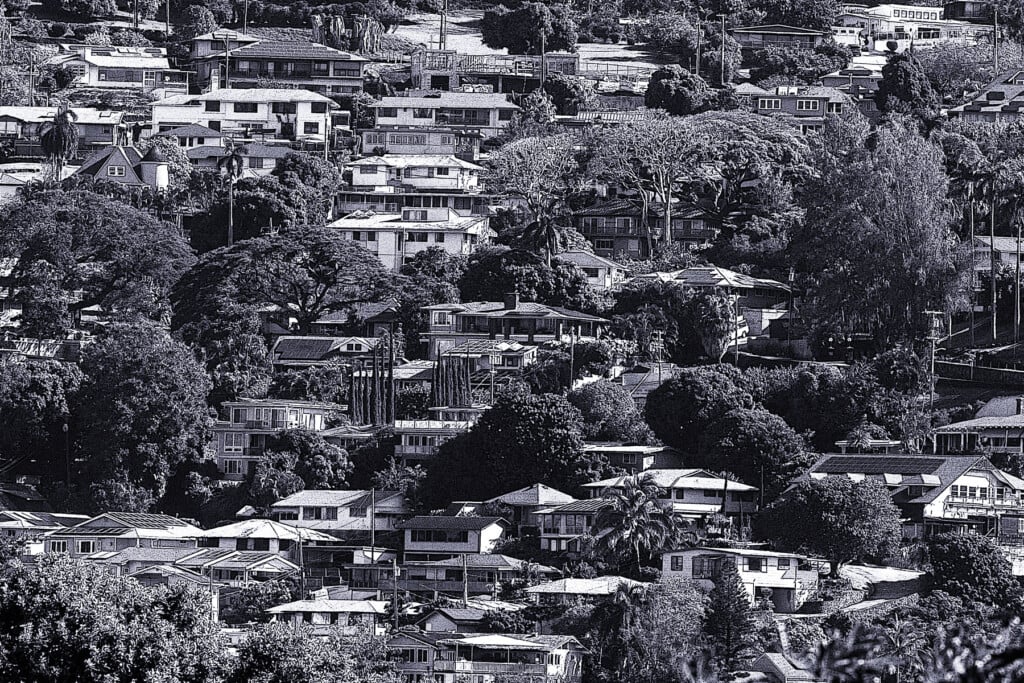

Properties with Two Homes Are a Bright Spot in the Weak Real Estate Market

Those properties are more likely to sell quickly, and they come with some extra financing options.

While high mortgage rates have priced a lot of potential homebuyers out of Hawaiʻi’s high-cost real estate market, some new financing options are available for anyone buying a property with an accessory dwelling unit or who plans to add an ADU after a purchase.

Having a rental unit on a property is attractive to a lot of buyers, who can use the rental income to help pay the mortgage or to accommodate extended family.

But the new financing options will benefit just a narrow niche of people, local real estate experts say.

The Federal Housing Administration recently announced a policy that allows lenders to count 75% of estimated rental income from an ADU when considering a borrower for an FHA mortgage.

Andrew Kim, president of Hawaiʻi Mortgage Group, says the number of borrowers the new rule will benefit in Hawaiʻi is likely low because it applies only to FHA mortgages, which make up a small percentage of the market.

Kim says other mortgage products already allow borrowers to count rental income so they qualify under the rules set by mortgage giants Fannie Mae and Freddie Mac, which buy and guarantee loans on the secondary mortgage market.

Andrew Kim is the president of Hawaiʻi Mortgage Group. | Photo: courtesy of Hawaiʻi Mortgage Group

“It’s not going to be substantial enough to move the needle for us,” says Kim. “But it’s such a challenge in our market for affordability so we’ll take whatever we can.”

And it’s not the only new option. To qualify under its 203(k) rehabilitation mortgage insurance program, which allows a buyer to borrow money to purchase a home and renovate it or build an ADU, the FHA counts 50% of estimated rental income. But Kim notes that not many lenders participate in the program; a search of the U.S. Department of Housing and Urban Development website turned up zero Hawaiʻi lenders participating in the 203(k) program.

Two Generations Buy One Property

The county has allowed ADUs to be built since 2015, when Mayor Kirk Caldwell signed the ADU ordinance into law; since then more than 850 have been constructed. An ADU may be built on a lot of at least 3,500 square feet that doesn’t already have a second home, and may be occupied by a family member or other tenant. Before that, Oʻahu had ʻohana zoning for accessory units that were only permitted to be occupied by a member of the family that lived in the main house.

A property with an ADU, ʻohana or other accessory rental unit will likely sell faster than a home without an accessory unit, says Cory Takata, a Realtor and partner at the Honolulu real estate firm Locations. Buyers looking for such homes to live in are also competing with investors who want ADUs for the extra cash flow, he says.

Cory Takata is a Realtor and partner at Locations. | Photo: courtesy of Locations Hawaii

“My listings with separate entry or an ADU, or an addition that allows that, actually move faster in this market than those that don’t have anything,” he says.

A lot of clients are forming hui with their parents or other family members to buy properties in neighborhoods where they would like to live but wouldn’t be able to afford on their own now that mortgage rates are above 7%. Takata says he’s also working with clients looking to purchase multigenerational homes; in some cases, parents are selling their existing homes and then buying multigenerational homes with their adult children.

“It’ll allow them to at least still have an opportunity to move into something in a certain neighborhood by going in with family,” he says. “We’re seeing it a lot now, because the kids are just getting priced out, especially the younger working professionals.”