Rule Change Lowers the Down Payment Needed When Buying Multifamily Properties

Fannie Mae now says only a 5% down payment is needed to buy a single property with two, three or four homes on it

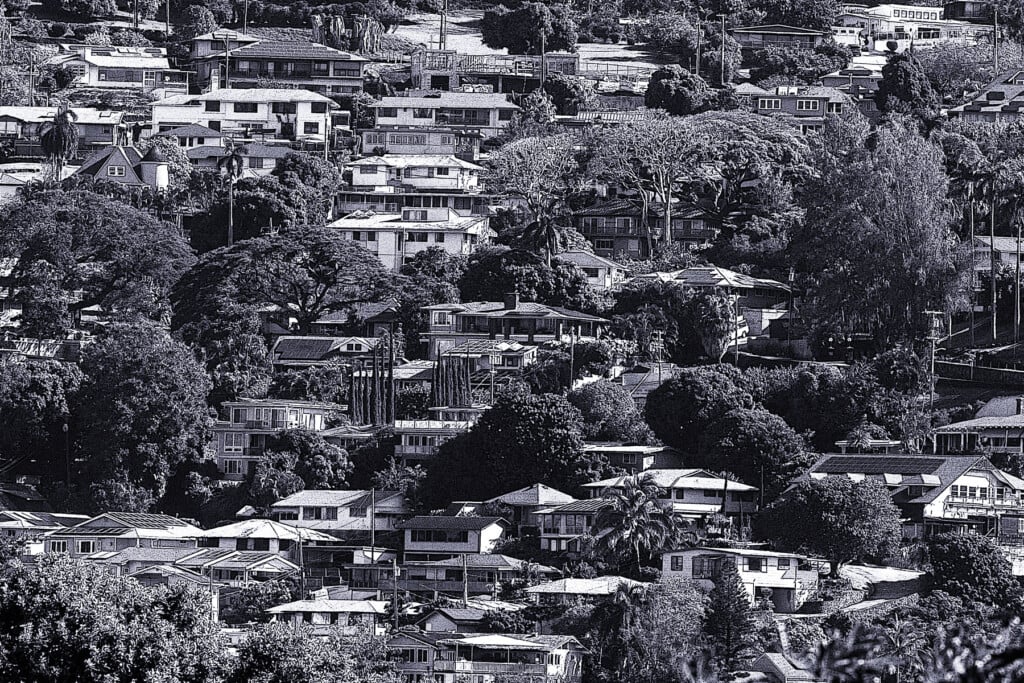

With so few properties for sale, trying to buy just one single-family home on Oʻahu is difficult these days, and high prices and interest rates are only adding to the problem. But a recent rule change by mortgage giant Fannie Mae could have some homebuyers looking at buying two homes with as little as 5% down.

And why stop at two? The new rule covers the purchase of multifamily properties with three or four units as well — and some of the projected rental income from each unit beyond the primary residence can help a buyer qualify for the mortgage.

The change involves the loan-to-value ratios for properties with two, three or four residential units, specifically slashing the amount of cash borrowers need to put down.

Until now, borrowers needed to put down at least 15% of the purchase price for a two-unit property, and pony up at least 25% for three- or four-unit properties.

That changes to 5% after Fannie Mae updates its software this coming weekend, which means a buyer can finance up to 95% of the purchase price for a two-to-four-unit property, according to an update Fannie Mae sent to lenders last month.

That’s great news for some buyers, says Brandon Lau, managing partner of ChaneyBrooks Choice Advisors, a real estate agency based in Honolulu.

“Any time that you can minimize the amount of cash to bring into a deal, it’s going to help, especially in this market,” says Lau. “If they’re legal rentals that you’re purchasing in addition to the primary unit, then you can use that income to help qualify for the loan, which is a huge benefit.”

The second unit could be an accessory dwelling unit, or ADU. Or it could be an existing second apartment in a house, or a second house on the property. Some properties on the market today have three or four units within one structure; other properties feature separate single-family homes. The down payment rule would also apply to apartment buildings with up to four units.

“People are looking for ways to try to make that monthly payment work,” says Lau, who is currently marketing a multifamily listing in Kailua with a six-bedroom main residence plus a second two-bedroom unit. One ideal way to make it work, he says, is by buying a property with a primary residence and a detached unit. “As long as it’s a legal rental, the income will qualify.”

Rental Income Can Be the Difference

The key is whether or not the rental unit has a legal full kitchen, which is defined as having a stove, a sink and a refrigerator. On Oʻahu, single-family homes are supposed to have one kitchen, but some properties may be zoned for more than one unit. An ADU is permitted to include a full separate kitchen under the City and County of Honolulu’s ADU law.

An apartment or other unit that isn’t permitted to have a separate kitchen may have a wet bar instead, which consists of a sink and a refrigerator, but “may not contain any fixture, appliance, or device for heating or cooking food, or a 220-volt outlet, which is necessary for a full sized stove,” according to the city.

Either way, Lau says more people see multifamily properties as a way to overcome today’s “affordability hurdle.”

“The reality is the monthly payment is too much for some people,” but, he says, rental income can help greatly. “It really provides flexibility in the ability to purchase right now.”

It’s also a way for some people to buy in urban Honolulu neighborhoods instead of moving to the suburbs of Central Oʻahu or West Oʻahu. However, given the low inventory of multifamily properties on the market, it could be tough to find a deal. Only about 66 of those properties can be found, in various sizes, on the Honolulu Board of Realtors’ HICentral Multiple Listing Service.

“It’s hard to find ones that have legal rentals. That is the challenge,” says Lau. “But they’re out there. It’s a matter of trying to scour the landscape finding the right property.”