Limit on Conventional Mortgages Will Go Up in 2024

The new ceiling will be almost $1.15 million in Hawai‘i. But with 7%-plus interest rates, there will be few takers.

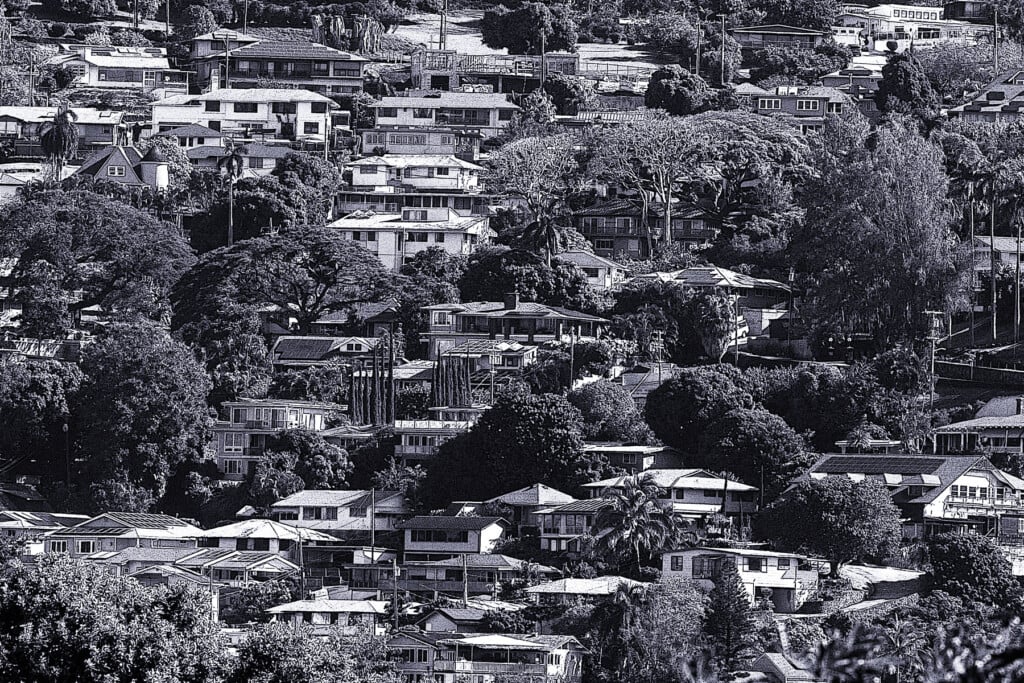

In 2024, qualified Hawaiʻi homebuyers will be able to borrow more money than this year – more than even the current median price of a single-family home on Oʻahu.

The 2024 limit for a 30-year mortgage loan that conforms to conditions set by Fannie Mae and Freddie Mac is $1,149,825, a 5.6% increase from the 2023 loan limit, and nearly $100,000 more than the median price for single-family homes on Oʻahu in October, which was $1.05 million.

The Federal Housing Finance Agency each year sets the maximum amount homebuyers can borrow on conforming mortgages. For most of the U.S., that maximum will be $766,500 in 2024, an increase of $40,350 from 2023.

Hawaiʻi, Alaska, Guam and the U.S. Virgin Islands, along with some pricey coastal metro areas and ski resorts, qualify for the higher loan limit, which is 150% higher than the limit for the rest of the U.S.

But with higher loan amounts come huge payments. At the current average rate of 7.22% for a 30-year mortgage, the monthly payment for a 2024 maximum-size loan would be $7,820.

And that monthly payment is on top of the cash the buyer puts down for the purchase of a home or condominium, which is typically 20% but can be lower depending on the loan. When rates were lower, some buyers would opt to put 10% down in cash and make up the remaining 10% with a second mortgage, but there is less appetite for that now.

“You’re not seeing a lot of people pushing the envelope now,” says Jon Whittington, managing director of Hawaiʻi Mortgage Group. “The affordability issue is real. There’s not a lot on the market.”

Depressed Market for Mortgages

The statistics for mortgage loans in Hawai‘i this year reflects that scarcity. The number of mortgages issued by local and mainland banks was down 57.5% during the first three quarters of this year, compared to the same period last year, according to Title Guaranty Hawaii’s Mortgage Barometer. The dollar volume dropped 73.6%.

Collectively, the four largest Hawaiʻi banks – American Savings Bank, Bank of Hawaiʻi, Central Pacific Bank and First Hawaiian Bank – fared about the same in their combined number of loans issued in the first three quarters, which was down 57.8%. But their dollar decline was less daunting at 61.9%.

Mortgage companies, which include national online lenders like Rocket Mortgage and LoanDepot.com, saw their loan numbers drop by 50% and dollar volume fall by 55%.

One of the issues affecting the market in Hawaiʻi and on the mainland is that homeowners who bought or refinanced before interest rates started climbing in March 2022 are reluctant to move or downsize because they don’t want to give up their relatively low monthly mortgage payments.

Because of that, “listings are way down,” notes Whittington.

“Unless you have enough equity to pay cash, you’d be paying more for a smaller house” because of the higher interest rates, he says. “Why would you do that?”