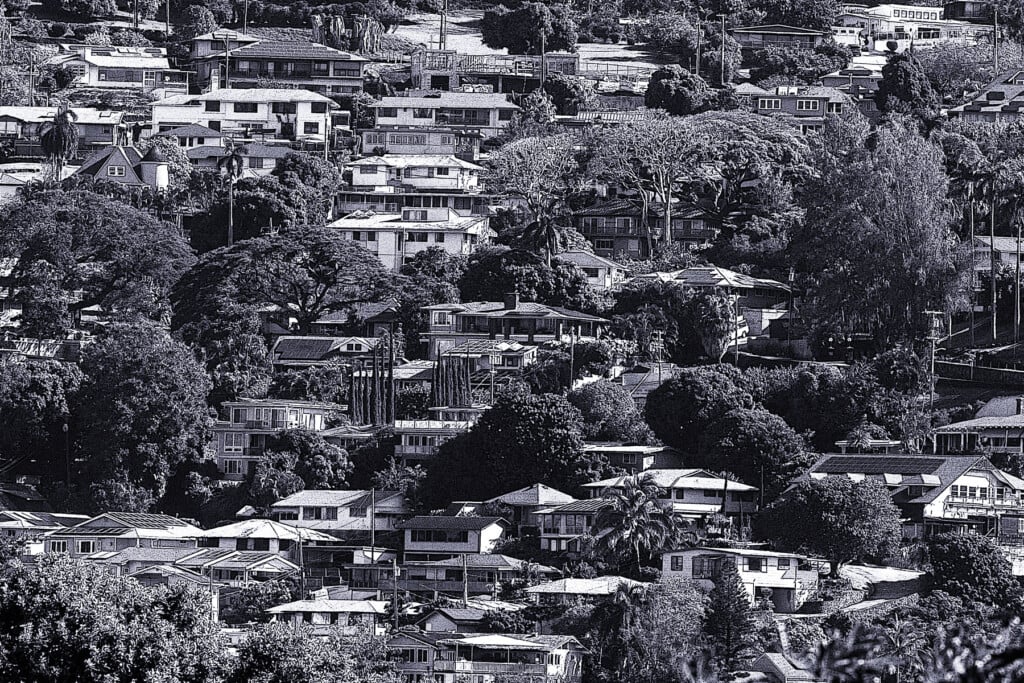

Good News on Interest Rates May Spur Real Estate Sales in 2024

Sales on O‘ahu have fallen nearly 30% so far in 2023, but a reversal is possible next year if mortgage rates decline.

After a year in which the number of homes sold plummeted and mortgage rates hit 20-year highs, Oʻahu’s real estate market got good news last week that may signal a rebound in 2024.

The good news began with the Federal Reserve. After raising interest rates 11 times between March 2022 and July 2023, the Fed has kept its benchmark rate between 5.25% and 5.5% and signaled three rate cuts in the coming year.

Then the average rate for a 30-year fixed-rate mortgage dropped below 7% – to 6.95% – for the first time since August, and Sam Khater, chief economist at Freddie Mac, said, “We will likely see a gradual thawing of the housing market in the new year.”

Additionally, National Association of Realtors Chief Economist Lawrence Yun forecast that home sales nationally will rise 13.5% from 2023 levels and that the national median price will reach $389,500 – a price point most Hawaiʻi homebuyers can only dream of – which would be an increase of 0.9%.

Fran Villarmia-Kahawai, a Realtor with Lifehouse Realty and 2023 president of the Honolulu Board of Realtors, says the board doesn’t forecast what sales or price increases might happen. But the latest news on interest rates will likely improve morale among its members after a year in which sales of single-family homes and condominiums are on track to finish nearly 30% below 2022.

“We feel pretty upbeat about it,” Villarmia-Kahawai says of 2024. “We think that it’s going to be a positive year next year.”

Slightly Lower Prices in 2023

For the first 11 months of this year, the islandwide median price of a single-family home on Oʻahu declined by 4.5% to $1.06 million, from $1.11 million during the same time in 2022. The median condo price was relatively flat at $508,500, just 0.3% below the 2022 median of $510,000.

Experts say that pent-up demand means there will likely be more potential buyers – and higher prices – once interest rates fall.

Fran Villarmia-Kahawai is a Realtor with Lifehouse Realty as well as 2023 president of the Honolulu Board of Realtors. | Photo: courtesy of Villarmia-Kahawai

“There were some people on the fence” about purchasing homes in 2023, and when rates went up they decided to wait, Villarmia-Kahawai says. “I think there are buyers who were hoping and praying for this interest rate decrease.”

More potential buyers means more competition, which means it’s going to be more important for buyers to have agents to represent them, she says.

That’s especially true for first-time buyers. Villarmia-Kahawai says people who want to buy their first condos or houses in 2024 should start working with real estate agents now instead of waiting for interest rates to come down further.

“Try to put your package together, so to speak, so that you can become a homeowner,”

she says. “They should be doing that now.”

Path for First-Time Buyers

One resource for first-time buyers is the Hawaiʻi Homeownership Center program that teaches potential homebuyers what they need to do to put themselves in a position to buy. The Honolulu Board of Realtors is one of the center’s sponsors and will cover $50 of the $60 one-time fee for anyone who uses a Realtor as a referral.

“It’s a lifetime fee,” says Villarmia-Kahawai. “Even if they don’t do anything for this year, but they pick it up next year, they’re in the system and they can gather information, educate themselves and get themselves in the position to become a homeowner.”

Meanwhile, the board is working on educating its members in the wake of several lawsuits challenging the traditional commission model in which sellers pay for both their agents and the buyer agents.

The board is asking brokers to train their agents on how to have the conversation about compensation for buyer agents.

“You just need to show your value and some of it is just sitting down and explaining to clients how it works, so they understand,” she says.